Affording a mortgage

Soaring home values and higher mortgage rates have made homes far less affordable over the last few years, keeping many would-be buyers on the sidelines. Here are insights and strategies that can help buyers navigate this challenging market.

The affordability challenge

2023 was a challenging year for home buyers. Mortgage rates rose to 23-year highs and the inventory crunch meant prices continued to rise in much of the country and made it difficult for each buyer to find a home that met their needs. “Rate lock” — homeowners who locked in long-term mortgages when rates were near 3% being reluctant to sell and take on a new mortgage with a much higher rate — is a big reason why.

*Source: Zillow's Chief Economist's 2024 Housing Market Resolutions

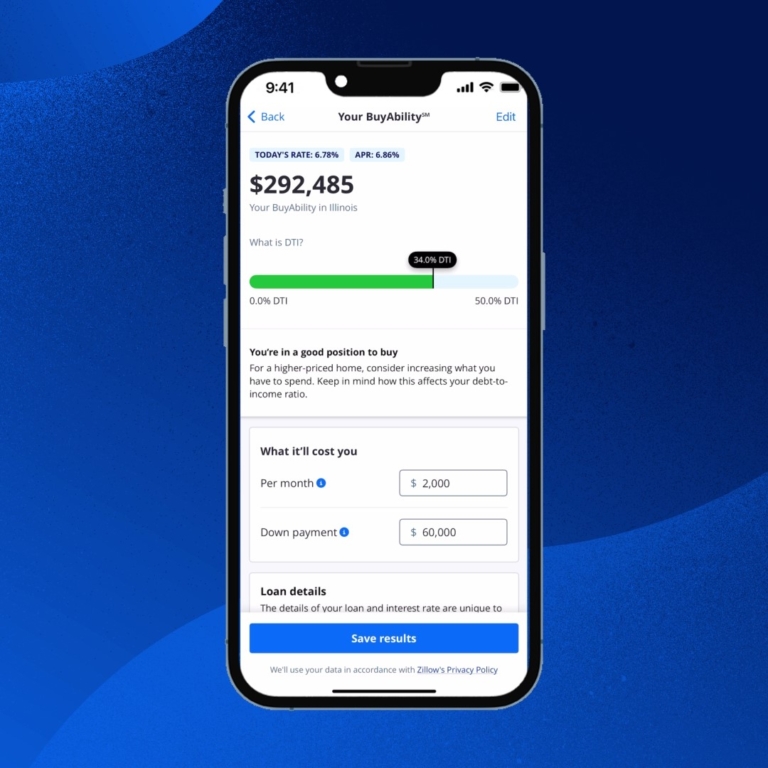

Search by BuyAbility

Created by Zillow Home Loans, the tool addresses one of the biggest considerations buyers face today: understanding what they can afford. Only offered on Zillow, BuyAbility gives buyers a personalized, real-time estimate of the home price and monthly payment that fits within their budget, and then gives insight into the likelihood of qualifying for a loan. BuyAbility is powered by real-time mortgage rates from Zillow Home Loans.

Find homes based on available budget with our BuyAbility tool

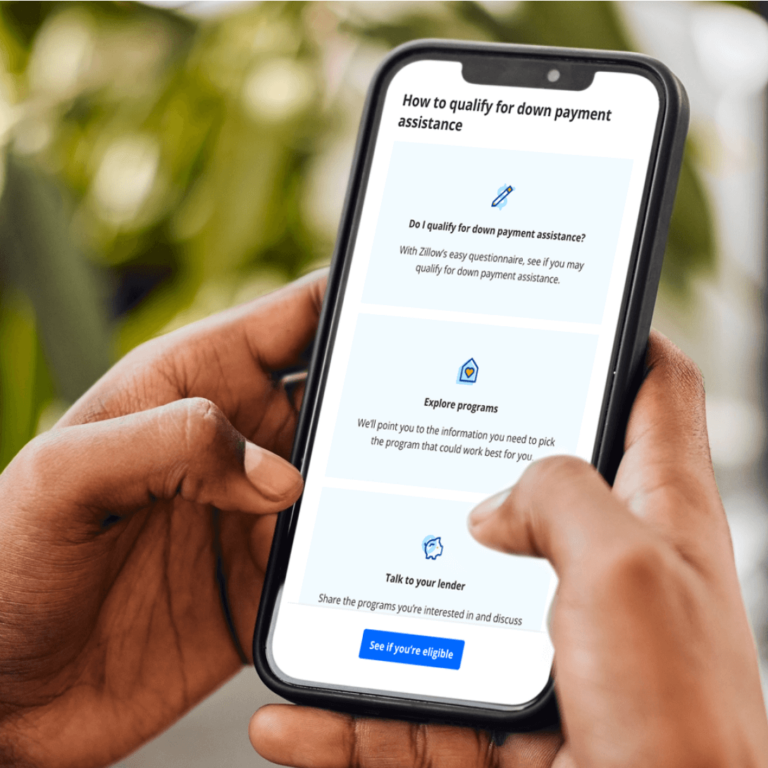

Down payment assistance

It’s possible to qualify for a home loan with a down payment as low as 3%, and in some cases, no money down with a down-payment assistance grant or loan, or a VA loan. Using a down-payment assistance program can also help home shoppers lower mortgage payments, build home equity faster or even purchase a home sooner. All home listings on Zillow display available programs that can help eligible shoppers with a down payment — the biggest barrier to homeownership for most.

Improving a credit score

For prospective buyers, a higher credit score can improve the chances of getting a lower interest rate on a mortgage. Buyers who have lower credit scores will especially benefit from building their credit before applying for home financing.

Buying mortgage points

Mortgage points, also known as discount points, are an option for buyers to pay an upfront fee to buy down the interest rate on their mortgage. The term “points” is a common way of referring to a percentage of your loan amount. When buyers choose to purchase mortgage discount points, they are essentially pre-paying interest up front in exchange for a lower rate and monthly payment over the life of the loan.

A recent survey by Zillow Home Loans finds nearly 45% of conventional primary home borrowers opted to purchase mortgage points in 2022 as a way to reduce their monthly payment.

In some cases, a seller may pay for a mortgage rate buydown on the buyer’s behalf. This is commonly referred to as a seller concession or seller credit.

How agents help

Agents can help buyers save money in several ways. They can help buyers avoid paying too much for a house, use negotiation strategies to get a better deal and ensure that all contractual obligations are fulfilled before the sale is finalized, so buyers don’t wind up in legal or financial hot water. Agents often know more about local lender affordable lending programs.

That’s why 89% of buyers use a real estate agent or broker.