In 1968, President Lyndon B. Johnson signed the Fair Housing Act, declaring, “Fair housing for all — all human beings who live in this country — is now a part of the American way of life.” If only that were a reality.

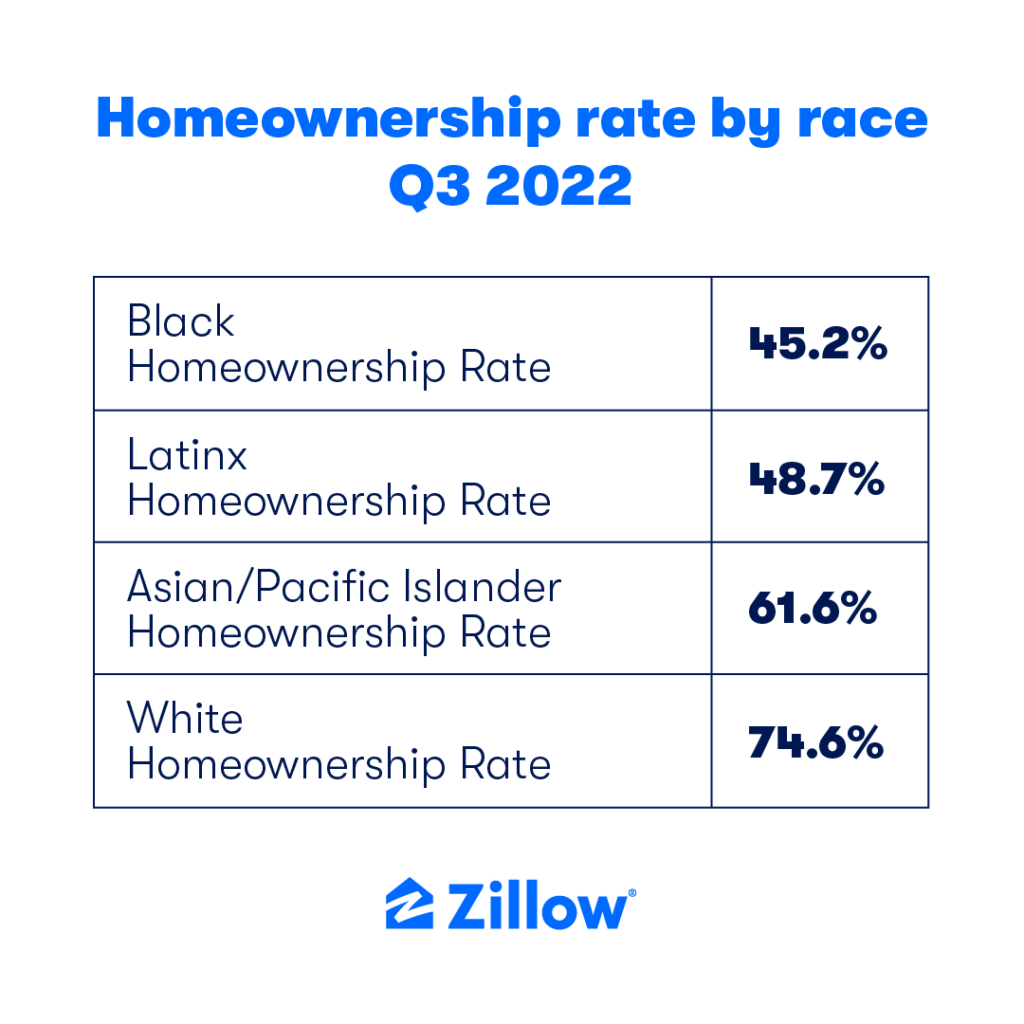

Five decades later, inequities in the U.S. housing industry persist, harming the stability and wealth of generations of BIPOC Americans. And despite recent glimmers of hope, progress has been excruciatingly slow. Though there have been some gains in relative home values, the homeownership gap has actually worsened. In the 1960s, there was a 27-point gap between Black homeownership (38%) and white homeownership (65%). Today, according to our most recent data, the gap is 29 points.

These inequities extend to the rental market as well. With the national average rent near $2,000 a month, many renters could be considered rent burdened, which means they spend more than 30% of their income on rent. This puts millions of renters on shaky financial ground, making it hard to save, pay bills or get through emergencies. And these burdens are unequal across races. Black and Latinx renters, on average, spend more of their income on rent — 34% and 32% respectively — than white renters do. In some communities, a Black renter might pay up to 50% of their income on rent.

At Zillow, we know that it is our responsibility to do what we can to help bring about meaningful change in the U.S. real estate industry. We use the power of our platform and position as a leader in our industry to speak out against racism in the housing industry and beyond. Most importantly, we put action behind those words, leveraging our data, economic research, products and advocacy to illuminate and impact the discrimination that plagues the housing sector.

Helping renters

Renters often face barriers when searching for a home. Rents in some areas have reached a point where it would take nearly four full-time workers to afford a single two-bedroom rental. Many states and municipalities still allow a landlord to refuse to rent to someone who depends on Social Security, public assistance or housing choice vouchers to make ends meet.

We’re stepping up to offer products, resources and advocacy to help fight discrimination in the rental market. According to Zillow Research, renters who are BIPOC typically submit more applications and pay more in application fees than white renters before they secure a place to live. With a median rental application fee of $50, the cost of multiple applications can add up quickly. That’s why Zillow created a reusable rental application. For a flat fee, prospective renters can use Zillow Applications to apply online for an unlimited number of participating properties over a 30-day period.

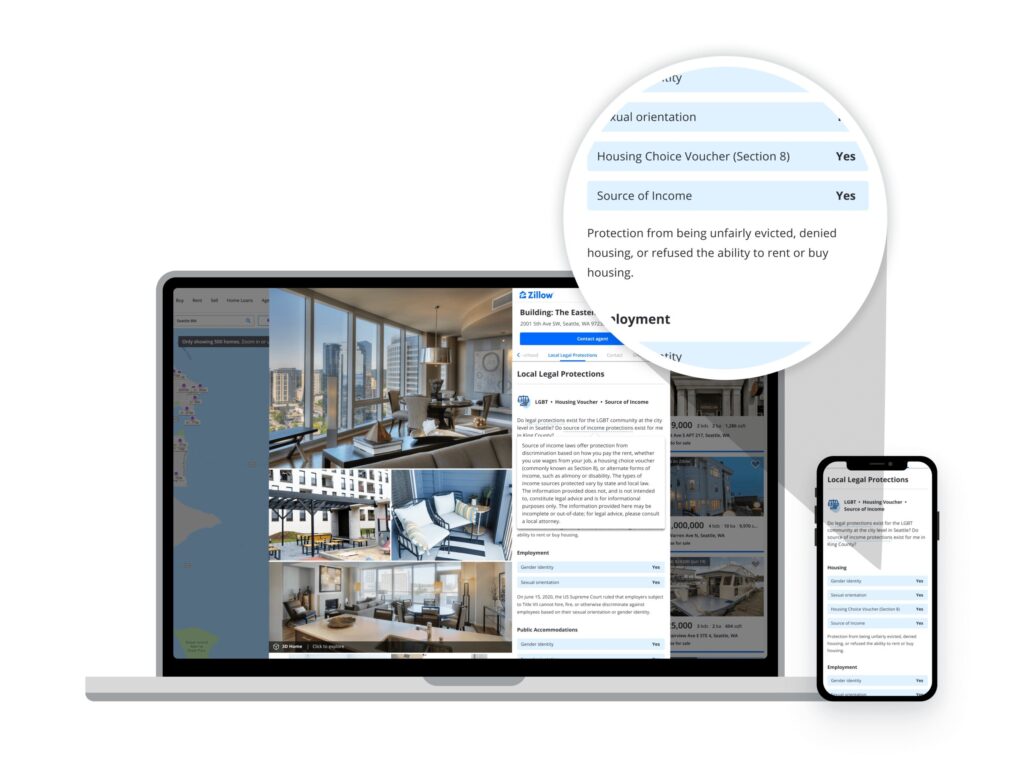

We help renters know their rights and work with housing providers to ensure those providers comply with fair housing rules. We also display local legal protections on rental listings, which empowers renters to better understand whether certain laws exist in the communities they are searching in. And last year, we partnered with fair housing leaders in Illinois to successfully pass source-of-income protections; the bill was signed into law by the governor, ensuring that all Illinois renters are protected from discrimination based on source of income. We will continue this advocacy in more states this year.

Exposing injustice

Zillow Research is working to shine a light on housing inequities by conducting research and sharing data that expose unfairness in all corners of housing. Our work helps to inform policymakers of the impact our country’s devastating history of housing discrimination continues to have on BIPOC households today. According to our research, housing accounts for nearly 40% of the $3 trillion wealth gap between Black and white households in the U.S. Further deepening this crisis are the challenges Black consumers face in accessing financing. For example, Zillow research found Black mortgage applicants are denied a loan 84% more often than white borrowers.

However, there have been recent gains. New Zillow research finds some improvement in Black Americans’ housing wealth. The gap between the value of the typical Black-owned home and the typical U.S. home is the smallest it’s been in the past two decades.

That said, the typical Black-owned home is still worth 14.8% less than the typical home overall. And for many Black Americans, barriers to homeownership persist. Many markets with the highest appreciation in Black home values also have the highest mortgage denial rates for Black applicants — meaning the markets where Black homeowners have the best chance of improving their household wealth are the markets where it’s most difficult for Black mortgage applicants to become homeowners.

Our drumbeat of data and research exposes the ongoing devastation of racism in housing, and serves as a call to action for policymakers to enact policies that enable a more fair and equitable housing experience for all.

Advocating for change

Zillow is on the record for calling on our government to take action, as well as championing policies that would expand access to housing for all people — especially BIPOC households — across the U.S.

One recent example is Zillow-supported legislation to establish a covenant homeownership account and program in Washington state. The legislation aims to help close the homeownership gap by establishing a new first-time home-buyer loan program directed toward individuals and families impacted by the state’s racially restrictive covenants. If passed, the legislation would establish a state-run special purpose credit program, offering assistance with down payments and closing costs. The bill is a proposal of the Black Home Initiative, a regional effort to address systemic housing equity issues in the Seattle region, an area where we have a sizable office footprint and employee population.

Programs like the covenant homeownership program are a significant step toward helping first-time home buyers achieve homeownership and closing the racial homeownership gap by providing direct support through closing-cost and down payment assistance, and pre- and post-purchase counseling. According to Zillow’s research, one of the most significant obstacles preventing potential home buyers from accessing homeownership is saving for a down payment, and 40% of all buyers rely on a gift or loan from family or friends for at least part of it. Additionally, two-thirds of renters across 20 major metro areas surveyed by Zillow cited affording a down payment as the biggest hurdle to buying a home. Zillow includes information on down payment assistance resources on every for-sale listing on its site to help potential buyers connect to one of the more than 2,000 assistance programs available across the United States.

Addressing the down payment barrier for first-time home buyers will help more members of BIPOC communities access the economic security that homeownership offers and can help close the homeownership gap.

Connections that change lives

A lack of affordable housing can turn into a housing crisis for many. Our research tells us that sharp increases in rent have a direct impact on rates of homelessness, and are considered by policymakers to be a primary cause of housing instability. Like many disparities in housing, these factors more severely impact BIPOC individuals, who experience homelessness at a higher rate than white people in the United States.

To address this growing crisis, Zillow launched a partnership with Housing Connector in early 2020 to help connect people experiencing homelessness with housing. In three short years, the partnership, which began in Seattle, has now expanded to Denver, helping nearly 4,500 people find a home — the majority of whom are people of color. There is much more work to be done, and we are working closely with Housing Connector to expand this program to more cities in 2023 and beyond.

This April, Zillow employees will help award $100,000 in community grants to organizations dedicated to expanding access to fair, equitable and affordable housing. This inaugural campaign is driven by our employees, who want to make an impactful connection in their communities.

Zillow is committed to staying in the fight, using tools like our research, advocacy and product innovation to help make housing more affordable, fair and accessible for all. Learn more by visiting Zillow’s fair housing research page.