Affordabilty is one of the biggest considerations home buyers face today. Understanding what they can afford is critical to help buyers focus their search, shop within their means and make informed decisions during this emotional and consequential process.

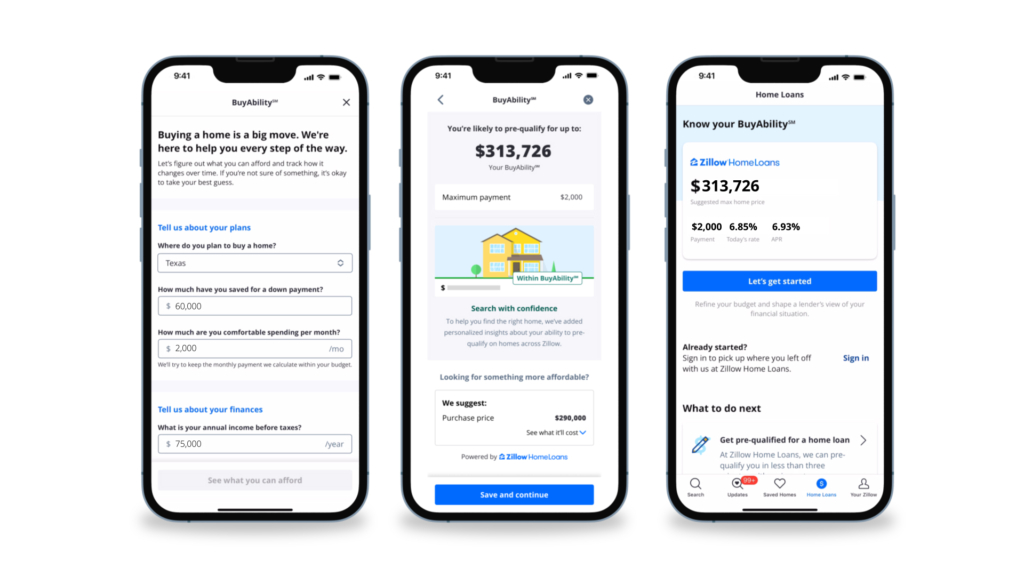

That’s why Zillow Home Loans created BuyAbility. First and only offered on Zillow, BuyAbility gives buyers a personalized, real-time estimate of the home price and monthly payment that fits within their budget, all powered by real-time mortgage rates from Zillow Home Loans. And now, buyers can see what homes fit within their BuyAbility while searching for homes on Zillow, allowing them to quickly identify homes that truly fit their budget.

BuyAbility is the most accurate way for a buyer to understand what they can afford. The interplay between mortgage rates and credit score play a crucial role in determining affordability, but most online calculators don’t factor these in. Buyers just need to add a few simple inputs unique to their financial situation, such as income, credit score and the monthly amount they’re comfortable spending, into BuyAbility. Within seconds, a personalized, real-time estimate of the home price and monthly payment that fits within their budget pops up, along with insight into their likelihood of getting approved for a mortgage at this price point.

Buyers can get started on the Home Loans tab on Zillow’s app. A shopper’s BuyAbility calculation will update regularly with changes to mortgage rates and their credit score.

“What many people don’t realize is that your mortgage rate is highly dependent on your credit score,” says Orphe Divounguy, senior economist at Zillow Home Loans. “The better your credit score, the lower the rate you’ll qualify for, potentially saving you hundreds of dollars a month. BuyAbility is personalized to a buyer’s credit score, income and down payment, and updated regularly to reflect current mortgage rates, giving home shoppers a true understanding of their buying power. BuyAbility is a great starting point for buyers who may be hesitant to look under the hood of their finances, or share personal details with a loan officer.”

If mortgage rates change, it impacts the home price a buyer can afford and their likelihood of getting approved for a mortgage, and BuyAbility will adjust for this in real-time. For example, a median-income household would be able to afford a $380,000 home with rates at 7%; if rates went down to 6%, that same household could afford a $420,000 home. Checking their BuyAbility regularly gives shoppers a clear and current understanding of their financial picture at any given moment.

BuyAbility will change the way people shop for homes. Since most people think about their finances in terms of monthly budgets, buyers are able to see how much each home they look at on Zillow would cost them on a monthly basis, based on their BuyAbility.

1Assuming fixed rates and a 20% down payment.