When people talk about the racial wealth gap in America, housing often comes up in charts and statistics. But behind those numbers are real families — parents removing family photos before an appraisal, renters priced out of neighborhoods where they’ve lived for generations, and first-time buyers met with closed doors when seeking financing.

The goal we all share is simple: a housing market that’s transparent and open to everyone. Here are a few stories that remind us why that matters — and the steps that communities, industry partners and consumers can take right now to make progress.

The emotional impact of redlining

Jillian White recalled growing up in Yonkers, New York, on a block that sat between redlined neighborhoods deemed too risky for investment and greenlined ones considered desirable. Years later, she found herself recommending that her parents whitewash their home — remove family photos and cultural markers — before putting it on the market.

“There’s one picture in particular. It’s my baby brother’s kindergarten graduation photo. And I remember saying to myself, ‘What will I do if this young Black boy catches me erasing all imagery of him from our home?’” White said. “When is the appropriate age to tell [him], ‘We are taking your pictures down because we believe if somebody knows you live here, they won’’t want to live here’?”

Her story echoes what countless families still face: home values and opportunities tied not to property, but to perceptions of the people inside those homes.

Persistent barriers to wealth building through homeownership

Attendees at last year’s Congressional Black Caucus Foundation’s Annual Legislative Conference spoke with us about the homeownership barriers they are facing across the country. One woman, a housing counselor, experienced appraisal bias firsthand when improvements to her home weren’t reflected in its valuation.

“It is very unfortunate in 2024 where so many people who are not aware where to direct things, or to challenge appraisals, don’t know where to go,” she said.

Another home buyer in Virginia recalled being rushed into locking in a loan rate while her white peers were given more flexible terms and better options. And Jonathan Prevost from Long Island described how his family was steered into communities of color and denied opportunities in more affluent neighborhoods.

“They essentially were being pushed to certain communities, particularly those of communities of color. They weren’t allowed to look into other more affluent, white communities,” Prevost said. “Practices like this made it very hard for a lot of people to get their homes or establish roots.”

Why it matters

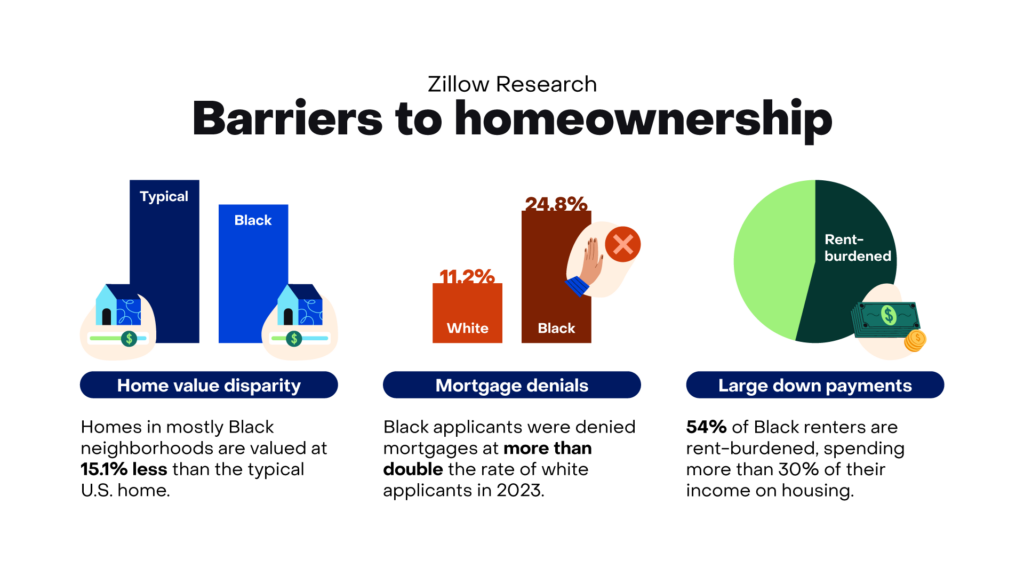

Homeownership remains one of the most reliable ways to build intergenerational wealth. Yet homes in predominantly Black neighborhoods are still valued 15.1% less than the typical U.S. home, accounting for a large portion of the racial wealth gap. And homeowners in majority-Black neighborhoods are often overtaxed, paying more in property taxes on homes that appraise for less.

Even when Black home buyers can afford mortgage payments, many are locked out by credit barriers. Black applicants were denied mortgages at more than double the rate of white applicants in 2023.And for renters, the barriers to homeownership can feel insurmountable. Rising rents leave little room in the budget to save for a down payment: Zillow research shows that 54% of Black renters are rent-burdened. This means they spend more than 30% of their income on housing.

Moving in the right direction

Communities, policymakers and companies are working toward solutions that can make homeownership more equitable.

- Down payment assistance (DPA): Nearly 70% of renters cite saving for a down payment as the biggest barrier to buying a home. Yet most aren’t aware of assistance programs that exist in their state or city. Expanding awareness and simplifying access to these programs could help millions of potential first-time buyers cross the threshold into ownership. Zillow’s DPA resource has already helped more than 5 million prospective buyers discover programs they may qualify for, bringing clarity and opportunity to a confusing process.

- Credit building through rent: Renters often pay on time for years without those payments being reflected in their credit history, which is a critical factor in mortgage approval. Allowing rent reporting to count toward credit can give renters a fairer shot at financing their first home. Zillow now offers the option for renters to report on-time rent payments to Experian and Equifax at no cost, helping them build stronger financial profiles each month.

- Transparency in affordability: Rising mortgage rates, property taxes and insurance costs have left many households unsure of what they can realistically afford. Tools that demystify monthly costs and spell out the tradeoffs clear can help prevent families from overextending themselves or being priced out. Zillow’s BuyAbilitySM integrates real-time mortgage rates with user financial data, giving buyers a personalized picture of their budget directly on home listings.

- Policy reform and advocacy: Long-term change requires systemic shifts, from local zoning reforms that allow “missing middle” housing to laws that curb appraisal bias and eliminate private listings. These policies help level the playing field for renters and buyers of color. Zillow supports these reforms through advocacy partnerships and research, using our data and voice to push for policies that expand access and affordability nationwide.

These solutions are only meaningful when people know they exist and understand how to use them. From financial literacy to awareness of local resources, Zillow is pushing to ensure communities of color are prepared to seize opportunities when they arise.

“I have come to realize that there are a lot of funding opportunities available for people of color to find housing and secure down payment assistance and other programs,” said one woman from Chicago.

Looking ahead

At events like the Congressional Black Caucus Foundation’s Annual Legislative Conference, where we’ll be hosting conversations on redlining and AI bias this year, Zillow is joining leaders and advocates who are working to reimagine housing as a tool for equity rather than exclusion.

We’re doing this because behind every statistic, there is a story. And behind every story is a family striving for the same thing: a safe, stable home and the chance to pass something on to the next generation.

At Zillow, we believe everyone deserves that chance, and we’re committed to making home a reality for more people every day.